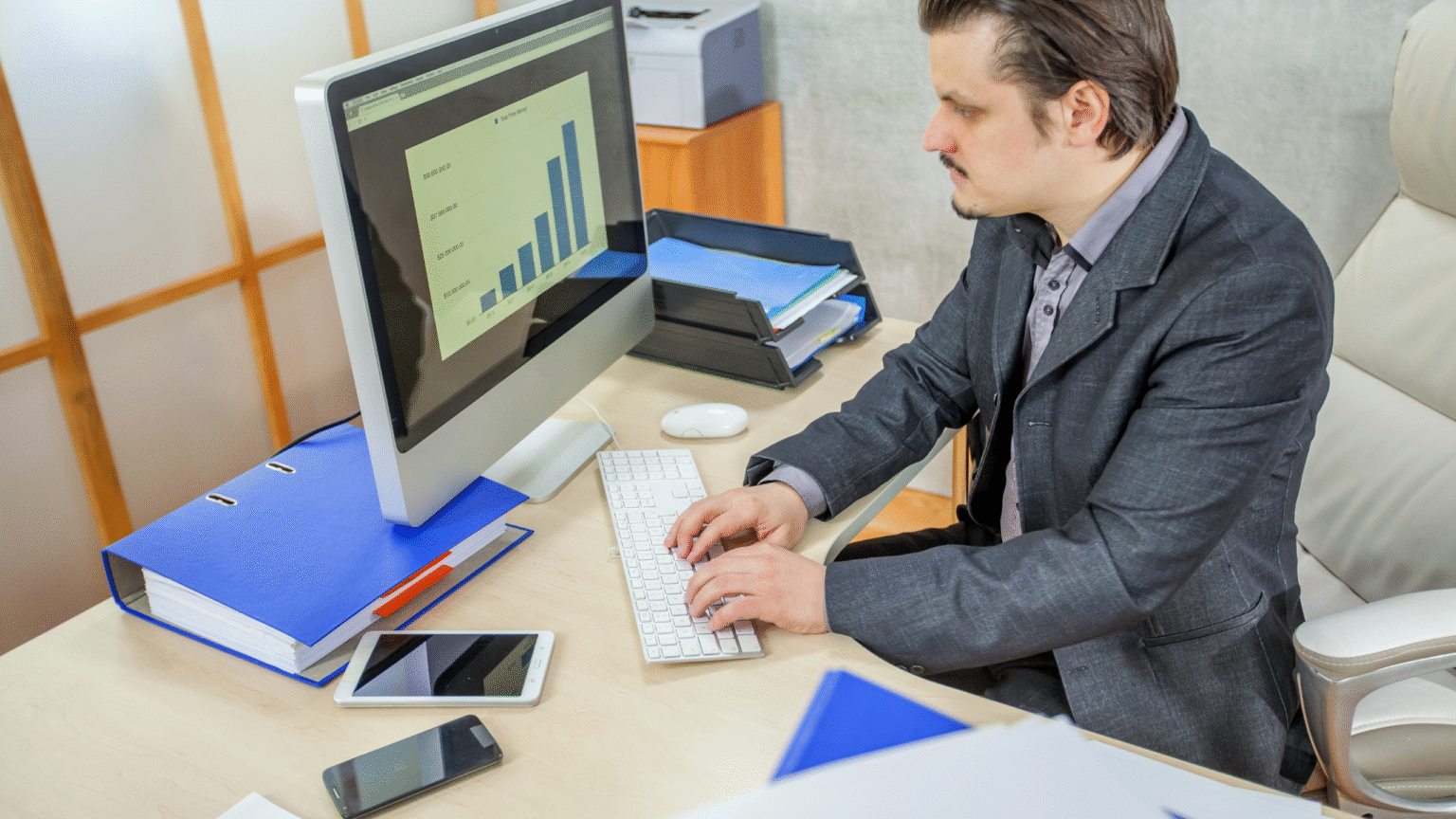

As a freelancer or consultant, your primary focus should be on delivering exceptional services—not chasing down payments. Yet, accounts receivable management can often become an overwhelming task, consuming valuable time that could otherwise be spent growing your business. Fortunately, automating your accounts receivable (AR) process is easier than ever, streamlining cash flow, minimizing administrative burdens, and enhancing client relationships.

Here’s your step-by-step guide to effectively automating your AR processes:

Selecting a reliable AR automation tool is foundational. Platforms like Beeceivables provide comprehensive solutions specifically designed for freelancers and consultants. Look for software with features like automated invoice generation, customizable reminders, payment tracking, and integrations with payment gateways such as Stripe or PayPal.

Automating invoice creation significantly reduces manual tasks. AR software allows you to generate invoices automatically based on predetermined schedules or milestones. Ensure each invoice clearly outlines payment terms, due dates, and acceptable payment methods, leaving no room for misunderstandings or disputes.

Timely reminders are crucial for maintaining cash flow without straining client relationships. Use automation to schedule friendly reminders via email or SMS, gently prompting clients as invoice deadlines approach. This consistency reduces overdue payments and keeps the communication professional and polite.

Integrating automated payment options directly into your invoices facilitates faster payments. Providing multiple convenient methods, such as credit card payments, direct bank transfers, or digital wallets, enhances client satisfaction by making it easy for them to pay promptly.

AR software enables real-time tracking of payments and automatic reconciliation. With tools like Beeceivables, each payment is logged immediately upon receipt, giving you instant clarity on outstanding balances. This automated tracking significantly reduces administrative effort, freeing you to focus on client service and business growth.

Automated AR platforms offer detailed analytics and reports on payment histories, cash flow projections, and client payment behaviors. Leveraging these insights helps identify patterns and potential issues early, allowing proactive strategies to manage cash flow and client relationships effectively.

Automation tools allow easy creation and management of customized payment plans. For clients needing additional time or special payment arrangements, you can set flexible terms within your automated system, effortlessly maintaining goodwill and client trust without increasing your workload.

By automating your AR process, you not only streamline operations but also experience multiple tangible benefits:

Improved Cash Flow: Faster and more reliable payments directly enhance financial stability.

Enhanced Client Relationships: Professional and consistent automated reminders preserve and strengthen client interactions.

Reduced Administrative Burden: Minimizing manual tasks allows you to focus more energy on delivering services and growing your business.

Increased Accuracy: Automation significantly reduces human errors in invoicing and reconciliation.

Beeceivables is a robust SaaS platform specifically crafted for freelancers and consultants seeking streamlined AR automation. Its intuitive interface and powerful integrations simplify invoice management, reminder scheduling, payment collection, and reconciliation tasks, helping your business thrive effortlessly.

Automating your accounts receivable process is not just about efficiency; it’s about building stronger client relationships, improving your cash flow, and enabling sustainable business growth. By choosing powerful AR automation tools like Beeceivables, freelancers and consultants can effortlessly manage their financial health, ensuring timely payments and maximum productivity.

Post Tags :

Share :

Get Started

Copyright © 2025 BEECEIVABLES